Real Estate Industry Trend: 2025

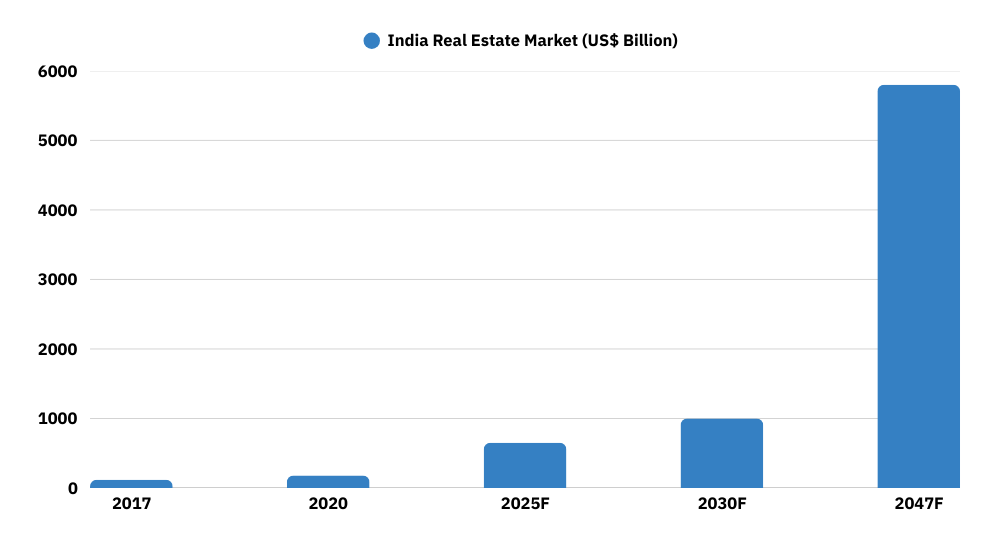

India real estate sector is expected to expand to US$ 5.8 trillion by 2047, contributing 15.5% to the GDP from an existing share of 7.3%.

ADVANTAGE INDIA

DEMAND

- •

India’s data center demand grows by 15-18 Million Sq. Ft. by 2025, driven by digital adoption, 5G, data localization, and key metro hubs.

- •

India’s luxury real estate sales grew 37.8% in 2024, driven by HNI demand and economic growth.

- •

India’s GCC market grew at 11% CAGR in 2024, driving office space demand and expansion in major cities.

OPPORTUNITIES

- •

Construction Sector Growth: Long-term (25 years): ~6.2% CAGR,Recent (2010-2023): ~7.5% CAGR.

- •

Labour Force Expansion: ~2% growth over the survey period.

- •

FY 2023 Employment: 71 million workers

- •

Real Estate Market Growth: 2023: $650 Billion,2030 (Projected): $1 Trillion

INVESTMENT

- •

Over 51% of financial and physical assets in India are in real estate.

- •

A FICCI-Anarock survey found 59% of respondents preferred real estate as their top investment choice across 14 Indian cities.

- •

Construction & real estate account for 5% of global greenfield FDI projects.

UNION BUDGET

- •

Urban Challenge Fund of INR 1 lakh crore to support key urban development initiatives from the July 2024 Budget.

- •

INR 10,000 crore allocated for FY 2025-26 to initiate projects.

- •

SWAMIH Fund 2 to be launched with a corpus of INR 15,000 crore following the success of SWAMIH Fund I.

Last updated: March, 2025

INTRODUCTION

India’s real estate market is entering a transformative phase, with 2025 marking a key turning point. Contributing 7% to the GDP in 2024, the sector is projected to grow to 13% by 2025 and 18% by 2047, in line with India’s anticipated $26 trillion economy at its centenary. The market size is set to surge from $300 billion in 2024 to $1 trillion by 2030, eventually reaching $4.8 trillion by 2047 (CREDAI-EY).

Equity investments in India’s real estate sector are expected to hit $10 billion in 2024, fueled by strong inflows into commercial spaces and sustained growth in residential real estate.

India's economy is expected to reach US$26t by 2047-48, with an 8% annual growth and a sixfold increase in per capita income.

There will be approximately 1 billion people in the middle class and 50% urbanization by 2047.

Indian Real Estate Market

Growing opportunities in India's expanding real estate sector

MARKET SIZE

Market Overview

By 2040, the real estate market will grow to Rs. 65,000 crore (US$ 9.30 billion) from Rs. 12,000 crore (US$ 1.72 billion) in 2019. Real estate sector in India is expected to reach US$ 1 trillion in market size by 2030, up from US$ 200 billion in 2021 and contribute 13% to India's GDP by 2025.

The Indian real estate market is projected to experience a substantial increase, potentially reaching a value of US$ 5.7 trillion by the year 2047, with the possibility of surpassing US$ 10 trillion.

In FY23, India's residential property market witnessed with the value of home sales reaching an all-time high of Rs. 3.47 lakh crore (US$ 42 billion), marking a robust 48% YoY increase.

GDP Growth Rate in India

GDP in 2023: $3.57 trillion; projected to reach $6 trillion by 2030.

Q4 2024 GDP Growth: 6.2% YoY (up from 5.6% in the previous quarter but slightly below the 6.3% market expectation).

Key Growth Drivers:

- Private Consumption Expenditure: 6.9% (vs 5.9% in Q3 2024).

- Public Expenditure: 8.3% (vs 3.8% in Q3 2024).

- Gross Fixed Capital Formation: 5.7% (vs 5.8% in Q3 2024).

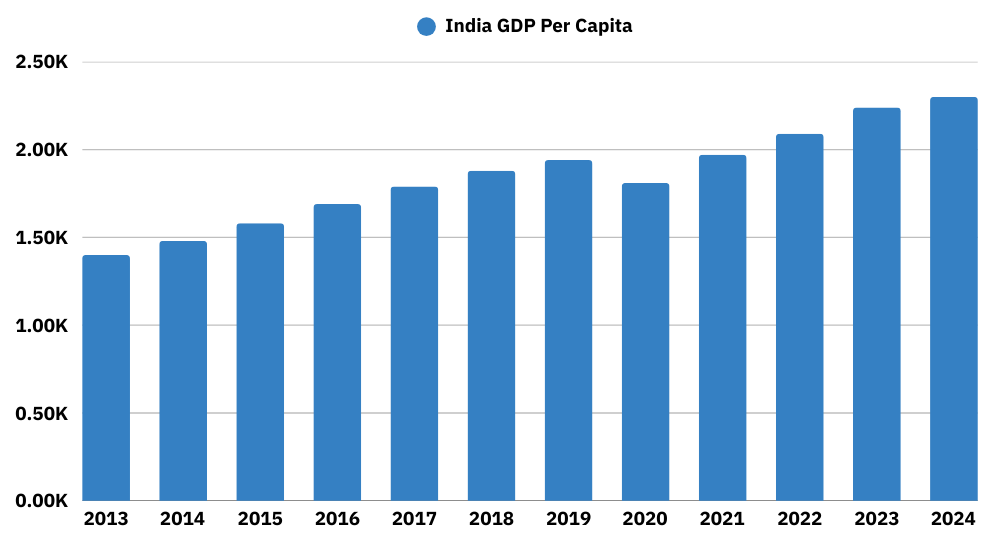

Per Capita Income Growth Rate

GDP Per Capita (2023): $2,236.31 (18% of the world average).

- Historical Trends:

- Average (1960-2023): $793.06

- Highest: $2,236.31 (2023)

- Lowest: $312.78 (1960)

- Net National Income (NNI) (FY 2025): ₹200,000 per capita

- Annual Growth Rate: 8.6% (compared to the previous year).

- Regional Standing (2020): Ranked 2nd in Asia-Pacific in Gross National Income (GNI), driven by strong GDP growth.

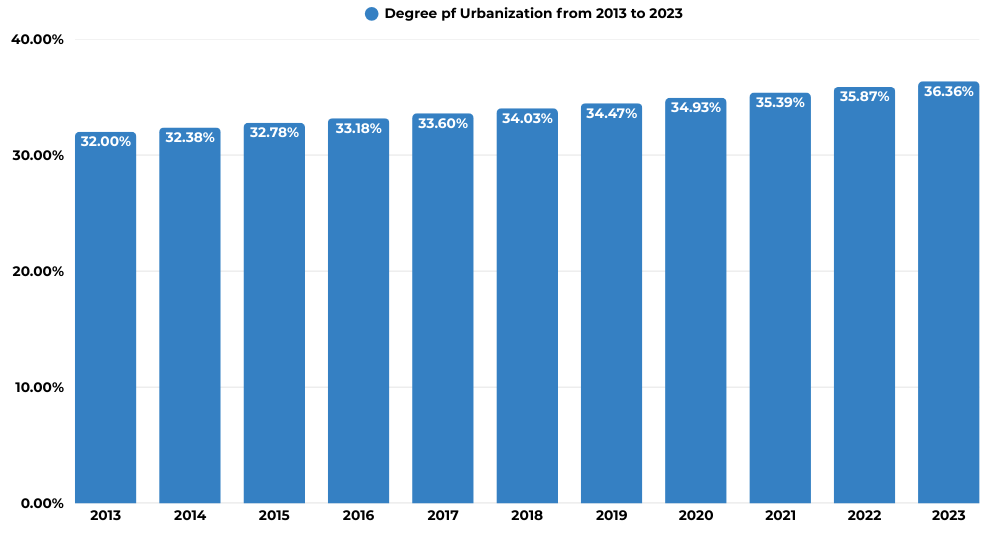

India’s Population & Urbanization Growth

Urban Population Projection: 600 million (40% of total population) by 2036.

Urbanization Growth: +4% in the last decade, driven by migration from rural areas for employment.

Economic Impact: Urban areas expected to contribute ~70% of India’s GDP.

Agriculture: Employs nearly 50% of the workforce but contributes less to GDP over time.

Agriculture still stable: 155M+ hectares of cultivated land (as of 2015)

Real Estate: India’s Leading Investment Asset Class

India’s residential market is expected to reach $1.04 trillion by 2029. Projected 25.6% CAGR growth.

It saw a 37% Year-on-Year (YoY) increase in the first half of FY 2024.

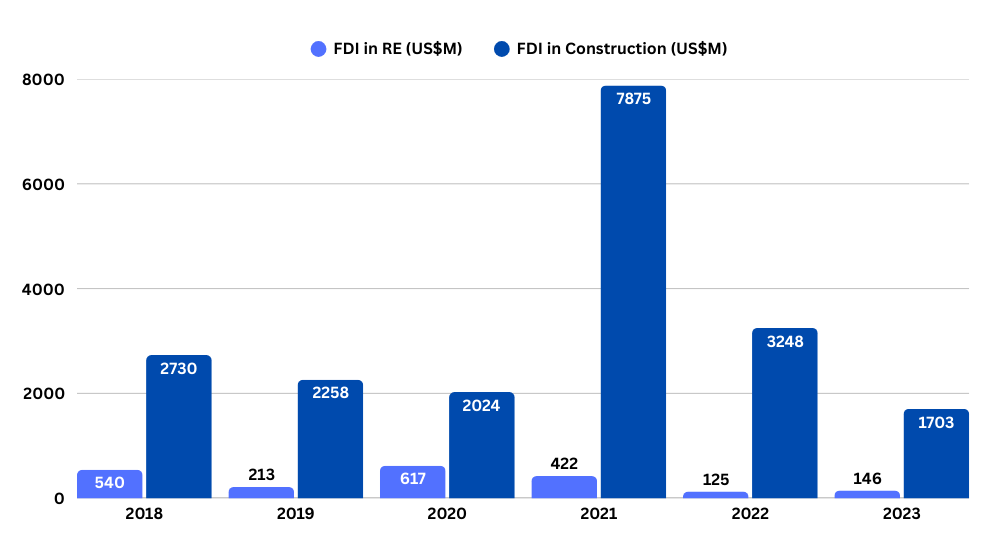

Foreign Investments in Indian Real Estate:

Foreign investors contribute approximately US$ 3.1 billion annually in Indian Market

Government Policies Helping the Real Estate Sector

Union Budget 2023-24 Announcement:

The Finance Ministry allocated Rs. 79,000 crore (US$ 9.64 billion) for PM Awas Yojana Scheme which shows a 66% increase compared to the previous year.

Affordable Housing Fund (AHF)

Established by the government within the National Housing Bank (NHB).

Initial corpus of Rs. 10,000 crore (US$ 1.43 billion).

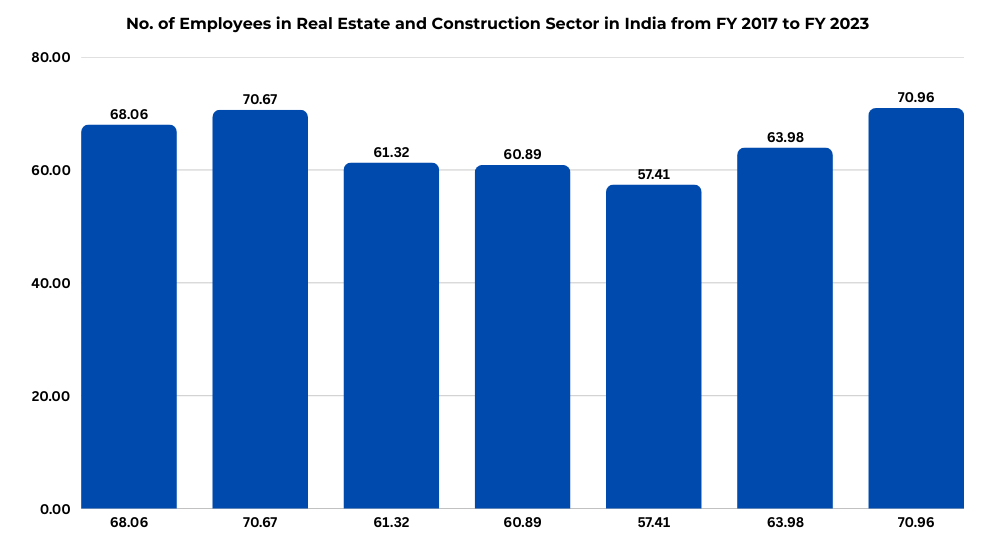

Employment Trend in India’s Real Estate & Construction Sector

FY 2023 Employment: 71 million workers.

Projected Workforce: 100 million employed in construction by 2030.

Long-term Growth (25 years): CAGR ~6.2%.

Recent Growth (2010-2023): ~7.5% CAGR.

Labour Force Expansion: ~2% growth over the survey period.

Key Amendments Proposed in Union Budget 2025 for the Real Estate Sector

Investment Incentives

In the budget 2024-25, under the PMAY-Urban 2.0 scheme, Rs 10 lakh crore (US$ 120.16 billion) will be invested in housing needs of 1 crore urban poor and middle-class families.

PMAY-Urban 2.0 scheme includes central support of Rs 2.2 lakh crore (US$ 26.44 billion) for the next 5 years.

The Union Budget 2025 was presented in the Lok Sabha on 01 February 2025 by the Hon’ble Finance Minister, and key amendments related to the Real Estate Sector were proposed in the Finance Bill 2025.

The Atmanirbhar Bharat 3.0 package was announced in November 2020 by Finance Minister Ms. Nirmala Sitharaman mentioned that Income tax relief measures were included for real estate developers and homebuyers for the primary purchase or sale of residential units valued up to Rs. 2 crore (US$ 271,450.60) from November 12, 2020, to June 30, 2021.

To revive around 1,600 stalled housing projects across top cities in the country, the setting up of a **Rs. 25,000 crore (US$ 3.58 billion) alternative investment fund (AIF)** was approved by the **Union Cabinet*.